China Warns of $1.9 Trillion 'Tsunami' as Tariff Warfare With U.S. Intensifies

China is preparing for a 'prolonged economic warfare' with Donald Trump after the president added additional tariffs on Beijing, while announcing a pause for other trading partners.

The communist country has invested numerous years developing a plan that shifted focus from erecting residences to investing approximately $1.9 trillion in setting up factories aimed at producing inexpensive goods for international sale. These efforts led to increases of 13% and 17% in 2023 and 2024 respectively.

Currently, Chinese firms that once offered price cuts to long-standing U.S. customers in response to Trump's tariffs are now considering abandoning the American market altogether as they seek out new purchasers.

Katherine Tai, who serves as Joe Biden's trade representative, warned about the closure of factories both in America and around the globe during an address to The New York Times 'The tsunami will affect everybody.'

China has begun implementing measures against U.S. firms, listing several additional entities on a trade blacklist which includes Shield AI and Sierra Nevada.

Another dozen U.S. firms — such as American Photonics and BRINC Drones — are now subject to export restrictions, as reported by The Verge. Wall Street Journal .

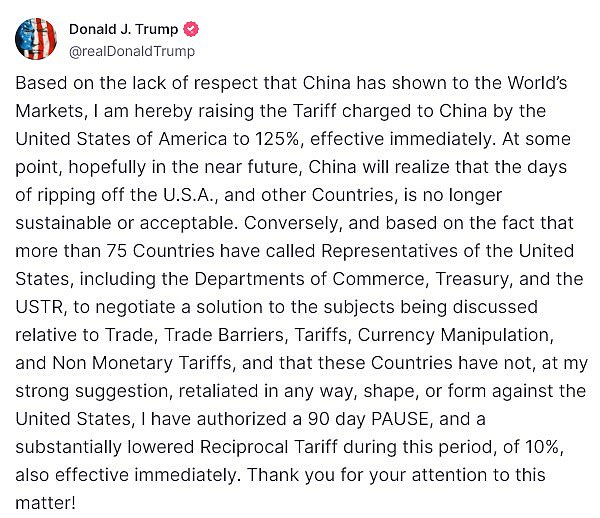

Trump announced a 125 percent tariff on China Wednesday morning, after the country had slapped a 'revenge tariff' of 84 percent on the United States in response to the 'Liberation Day' duty.

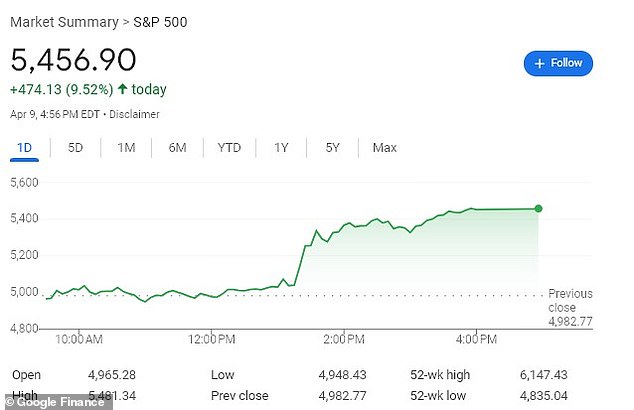

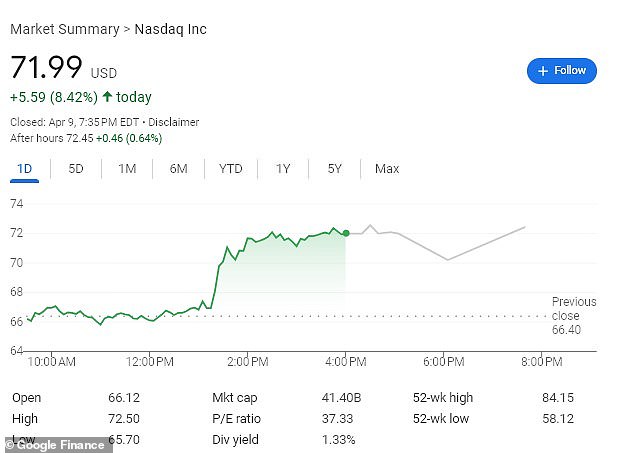

The president also declared a 90-day halt on all new 'reciprocal' taxes On Wednesday, this marked a significant shift that led to one of the largest stock market events in history, highlighting China for its 'disrespect... towards the Global Market.'

Trump exulted over outmaneuvering Xi Jinping in a post on Truth Social late Wednesday night: "What a day! But even greater days lie ahead!!!"

Beijing is expected to implement additional export restrictions on materials crucial for American companies to produce semiconductors and other goods. This may be accompanied by daunting regulatory probes and penalties against these firms.

Blacklists may expand as well, aiming to compel American companies to relinquish their intellectual property or face prohibition from operating within China.

This might be dangerous because over 200 U.S. firms have mentioned in recent times that China represents their primary geopolitical risk factor, says a report from the U.S. Chamber of Commerce Foundation.

China's official media outlets have stayed consistent in their messaging, as the Chinese Commerce Ministry stated: "Should the U.S. persist in its course of action, China will be compelled to see this through to the very end."

Beijing has similarly turned to Southeast Asian nations such as Cambodia, Laos, and Thailand to offset trade imbalances.

Currently, Chinese firms are experiencing cancellations from their American partners.

Following Trump's extra tariff increase, the manager of a toy manufacturing plant in Guangdong stated that a customer from Baltimore promptly cancelled an order scheduled for delivery in June, which was initially set to be placed in March. The client apologized in Chinese.

Following Chen’s offer of a 10 percent discount to an American client he’d been working with for more than ten years as a reaction to the original tariffs, the cancellation ensued.

Nevertheless, he referred to the latest hikes as a 'deal-breaker' and stated that there was 'no longer any room for conducting business, for either party.'

"We're both quite sorrowful, yet we can't change the situation," he stated. WSJ , with an indication that many more cancellations are expected on a significant scale.

Garment and machine manufacturers have informed the authorities New York Times They are concerned about upcoming orders and if employees will retain their positions over the next few weeks.

Shipments from China to the U.S. might decrease by up to 50% in the coming period if these tariffs persist, as stated by Capital Economics.

Although numerous Chinese factories replicated Chen’s approach and provided discounts, recent tariffs have established a boundary that some firms refuse to cross. They've decided to absorb the costs rather than risk losing business from American clients, who now demand up to two or three times more discount compared to what Chen originally offered.

Rather than that, they will attempt to locate purchasers from different nations or perhaps delay or halt production with the aim of shifting the responsibility onto U.S. importers.

Experts are now predicting that the prices for Apple products — mostly manufactured in China — will rise sharply.

In the end, China might try to wage this conflict by working to strengthen itself internally.

In recent years, the nation has shifted its focus from substantially supporting residential construction to investing nearly $2 trillion in factory development.

Chinese automaker BYD is currently building two facilities that will surpass the size of the world’s largest plant, which is located in Germany and operated by Volkswagen.

They have likewise concentrated on facilities that manufacture vehicles, smartphones, and even fertilizers, intended for global distribution.

Imports account for 20 percent of China's GDP, following significant growth in exports over the last two years.

Conversely, American exports have decreased, now constituting just 11 percent of GDP, a decline from 13.6 percent in 2012.

The U.S. Trade Representative stated that American exports to China decreased by three percent in 2024, amounting to $144 billion.

The trade gap between America and China expanded to $295 billion.

Trump has signaled the US could respond by firing up domestic production of the likes of the iPhone, buoyed by Apple's decision to invest $500 billion to expand its facilities Stateside over the next four years.

However, Harry Mills, the founder of the specialized currency management company Oku Markets, informed DIWIDA.NEWS: "Achieving this would require an immense coordination challenge for relocating a massive supply chain, which could result in significant price hikes over time due to substantially higher labor costs in the U.S. compared to those in China and Taiwan."

Many of Apple's products are manufactured in China, yet their components originate from roughly 50 different nations—each having faced tariffs imposed by Donald Trump.

The analysis of supplier data for the Apple company indicates that 84 percent of iPhone component providers have connections to mainland China, accounting for 158 out of 188 suppliers.

Trump was forced to backtrack on his sweeping tariff plans because of a 'fire sale' in the bond market which could have triggered economic meltdown but taking China to task for its disrespect.

Alongside triggering chaos in the stock exchange Trump’s extensive tariff proposals triggered a significant sell-off in U.S. government bonds, an event rivaling the magnitude observed during the peak of the COVID-19 crisis.

Experts are stating that it was this, more about the 'craft of negotiation' ', leading the White House to retract its tariff plans.

On Wednesday, the President declared a 90-day halt on all new 'reciprocal' tariffs , marking a significant turnaround that led to one of the largest stock market rallies ever recorded.

Nevertheless, he did not hold back from targeting China, imposing additional rounds of import duties on Beijing.

"In light of China’s disregard for global market norms, I have decided to increase the tariff imposed on Chinese goods by the United States to 125% with immediate effect," he stated.

'Someday, ideally soon, China will come to understand that the era of exploiting the United States and other nations must end as it is neither viable nor tolerable.'

The intense sell-off in the bond market reached its peak late Tuesday and continued into Wednesday.

Overnight, the 10-year Treasury yield rose above 4.51 percent, and on Tuesday evening, the 30-year Treasury yield reached a peak of 5.02 percent. CNBC reported.

U.S. government bonds have historically been regarded as one of the most secure investments globally, serving as a refuge for capital during periods of market turbulence.

However, this abrupt decline served as one of the most evident indicators that investors might be starting to doubt the safety they once associated with these assets—and it also highlighted the significant impact that President Trump’s tariff proposals had on the world’s largest economy.

Treasury Secretary Scott Bessent maintained that the choice to postpone the tariffs was due to 'the president's strategy' instead of the significant increase in bond yields.

"He and I engaged in an extensive discussion on Sunday, and this has been his approach from the beginning," he informed journalists gathered outside the White House on Wednesday.

However, Trump indicated that he was carefully monitoring the bond market as he opted for a halt. "The bond market looks great at this moment," Trump stated to journalists.

'Last night I noticed some folks starting to feel nauseous.'

Read more